Financial analysts project that the net interest income of the oldest financial conglomerate in Africa’s most populous nation will hit a landmark N1 trillion at the end of the 2024 financial year.

The projection hinges on the elevated interest rate environment and potential improvements in cost-of-risk (CoR).

Background

FBNHoldings is a multifaceted and one of the largest financial services organisations in Africa. It is well-diversified essentially along Commercial Banking, Merchant Banking, Capital Markets, Trusteeship and Insurance brokerage.

Established in 1894, FirstBank was founded by Sir Alfred Jones, a shipping magnate from Liverpool, England. With its head office originally in Liverpool, the Bank commenced business on a modest scale in Lagos, Nigeria under the name, Bank of British West Africa (BBWA).

Board

The eight-member board of FBNH Plc is led by Femi Otedola, who was appointed Chairman of the Board of Directors of FBN Holdings Plc on January 31 2024. He is a visionary entrepreneur with a track record of pioneering businesses, and growing and transforming corporations.

His first foray into the downstream sector of the oil and gas industry began with Zenon Petroleum and Gas Limited thus disrupting and redefining standards in the industry. He thereafter initiated the purchase of majority shareholding in the then African Petroleum Plc in May 2007 and became the Chairman of the Board on May 25, 2007.

His vision transformed African Petroleum Plc into Forte Oil Plc (FO Plc). The company grew in leaps and bounds to become a model of the possibilities inherent in Nigeria, winning numerous accolades in recognition of the successful business turnaround, diversified portfolio, prompt financial reporting, strong corporate governance, and investment of choice within the oil and gas industry.

Financial projection for FY’24

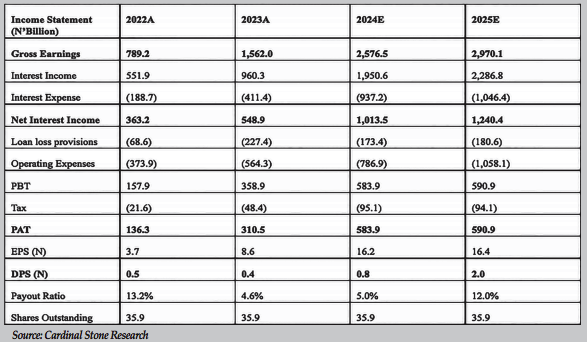

Based on analysts’ projections, FBNH is expected to grow its Profit after Tax by about 88.1 percent year-on-year to N583.95 billion in FY’24E, aided by an expected surge in net interest income (NII) to N1.0 trillion (+84.6% YoY) and a modest uptick in noninterest-revenue-(-NIR) to N625.8 billion (+4.0% YoY). Additionally, they (analysts) forecast CoR at 1.8 percent, in line with management’s guidance of below 2.0 percent and lower than the Q1 ’24 level of 2.2 percent.

CoR expectation is also below the elevated 3.4 percent recorded in FY’23. The projected CoR level should be supported by lower impairment charges and an increase in gross loans, both of which bode well for after-tax earnings and ROE (+6.2ppts to 28.8%).

A report from CardinalStone Research disclosed “In FY ’24, we estimate that NII will be a tailwind for FBNH’s gross earnings, offsetting the potential slowdown in NIR. Specifically, the prevailing elevated yield environment and FBNH’s material stock of interest-earning assets should propel NII higher. We note that the group had already grown NII by 2.0x in Q1 ’24, supported by a 1.1% YoY increase in NIM to 6.9% and a 93.6% increase in interest-earning assets (IEA) to N15.4 trillion.

“FBNHoldings has again delivered a strong set of financial results despite the complex macroeconomic and operating environment. Our Group’s strong performance over the period is underpinned by our robust institutional capabilities, effective risk management practices and solid business momentum, and it is a testament to the resilience of our institution”

“This jump in IEA was primarily driven by the growth in loans and advances (+113.3% YoY), which constitute 54.6% of IEA. Although we note that the 30.7% Q1 ’24 naira devaluation may have bloated loans, FBNH’s track record of strong organic loan growth (3-year average of 26.8%) supports our projection for a c.45.0% expansion in gross loans in FY’24 estimate.

“Conversely, we anticipate a modest 4.0% improvement in NIR, primarily driven by higher transaction fee income, particularly in letters of credit commissions and fees. The slower growth in NIR (vs. the 153.6% surge in FY’23) should reflect a decline in FX-related revaluation gains. We recall that major FX reforms resulted in a foreign exchange gain of N382.2 billion in FY’23, but note that NIR would still have risen by 52.4% in the financial year without the exchange gains. Interestingly, this strong core performance was supported by the 3.8x surge in fee and commission income from letters of credit commissions and fees. We expect the support from these drivers to subsist in the current financial year, aided by strategic measures such as improving support for trade transactions.”

The analysts foresee a moderation in the cost-to-income ratio (CIR) to 48.0 percent in the FY’24 estimate compared to the 5-year average of 68.2 percent and FY’23 level of 49.0 percent. While operating expenses are likely to remain elevated in the fiscal year due to inflation and regulatory costs, gains from higher yields and improved contributions from trading and transaction-based income should drive a 42.5 percent YoY rise in operating income. On operating expenses, elevated inflation and higher AMCON levies (+66.0% YoY in Q1’24 alone) are likely to be the key pressure points.

Elsewhere, Cardinal Stone projected impairment charges 23.7 percent lower at N173.4 billion, with CoR at 1.8 percent compared to 3.4 percent in FY’23.

According to management, the higher impairment charge for FY’23 was due to the impact of revaluation and its strategy of maintaining an adequate coverage ratio. However, the group has been guided to a CoR below 2.0 percent for FY’24. The moderation in NPLs and relatively higher NPL coverage of 88.2 percent in Q1’24 (above the 5-year mean of 67.2%) support a slowdown in COR.

Management’s comment on H1’24 performance

The Group Managing Director, Nnamdi Okonkwo, commented, “FBNHoldings has again delivered a strong set of financial results despite the complex macroeconomic and operating environment. Our Group’s strong performance over the period is underpinned by our robust institutional capabilities, effective risk management practices and solid business momentum, and it is a testament to the resilience of our institution. Notably, gross earnings and profit before tax grew 118.8% y-o-y and 100.9% y-o-y to N1,402.5 billion and N412 billion respectively for the first half of the financial year, showing a continuous growth trajectory. These results reflect our ongoing commitment towards further improving profitability, enhancing performance and delivering sustainable value to our stakeholders. Despite the macro-economic headwinds, we remain resolute and confident of successfully navigating the terrain towards surpassing stakeholders’ expectations.”

Planned recapitalisation

To support its business expansion and align with new regulations for international bank capital requirements, FBNH intends to raise capital in FY’24. The proposed raise is expected to be above its capital shortfall of c.N248.7 billion.

According to management, the group will explore all options to raise capital. The eventual capital inflow should allow the bank to leverage growth opportunities and strengthen its Capital Adequacy Ratio (CAR), which has stayed 170bps above the regulatory minimum of 15.0 percent for the last 5 years.

Stronger capital to boost dividend

Despite the CBN’s exclusion of retained earnings for new capital requirements, FBNH declared a 40 Kobo per share dividend for FY’23 (vs 50 Kobo per share in FY’22).

According to management, FBNH decided to retain more capital in the banking subsidiary by limiting the dividend upstream to the holding company (Holdco), following the 60bps moderation in CAR to 16.6 percent in FY’22. Therefore, the strategic decision enabled First Bank to retain earnings whilst also boosting capital to print a higher CAR of 17.9 percent (vs. 16.6%). In light of the expected capital raise, FBNH plans to raise both Tier 1 and Tier 2 capital, to complete the Tier 1 capital raise this year.

Management anticipates that this increase in Tier 1 capital will drive CAR above 20.0%, with the subsequent Tier 2 capital expected to raise it even further, thereby positioning the bank for greater financial stability and growth. In our view, stronger capital ratios should create more willingness to reward shareholders and increase the dividend payout ratio.

Valuation

Net adjustments Cardinal Stone’s model resulted in a 12-month target price (TP) of N31.75 (vs N32.26 previously). “Our TP reflects the expected impact of higher yields on overall performance and 2) contained CIR as higher operating income moderates the impact of higher OPEX. Our TP implies an exit P/B multiple of 0.5x, which is at par with the 5-year historical mean level. It also suggests a potential 50.5% upside to our reference price of N20.10 and a BUY rating on the counter.”