- NNPC announces plan to list on stock market

The Federal Government has said that the Highways Management and Development Initiative will facilitate the concessions of major highways to improve road infrastructure.

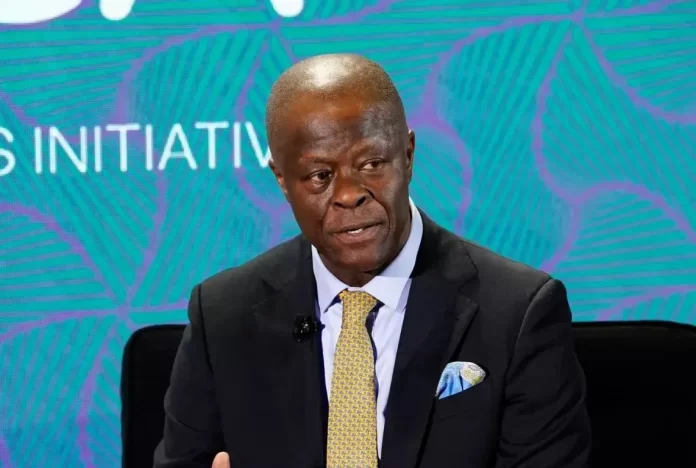

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, made this announcement during a Zoom dialogue meeting in Abuja on Thursday.

“The Highways Management and Development Initiative would facilitate the concessioning of major highways to improve road infrastructure,” he said.

Edun began by outlining the significant progress Nigeria’s economy has made in the last 18 to 20 months, having narrowly avoided collapse after relying on illegally borrowed central bank funds that far exceeded regulatory limits.

“Where we are now is that, in the last quarter of 2024, the economy grew at roughly 3.84 per cent, which is close to the annual target of 3.4 per cent,” Edun said.

He noted that inflation had begun to ease, dropping by 1.3 percentage points between January and February, while food inflation also showed signs of decline. The cost of petroleum and energy, he added, had decreased due to sectoral dynamics.

The Minister also highlighted the stabilisation of the exchange rate, which has positively impacted the cost of imported goods and services, particularly in sectors such as healthcare and education.

“Additionally, the cost of petroleum and energy is down due to sectoral dynamics,” he explained.

Edun further noted that Nigeria’s balance of trade had turned positive, with government revenues increasing by 20 per cent in 2024.

The country’s budget deficit was reducing, and debt servicing as a percentage of revenue had dropped, contributing to an overall improvement in living standards.

“With this progress, the government is now focusing on further stabilisation and creating an environment that encourages private sector investment,” Edun said, stressing the importance of leveraging technology to boost revenue from government-owned enterprises.

On the proposed tax reform bill, Edun revealed that it would see an increase in the top-end personal income tax rate from 18.6 percent to 25 percent, alongside efforts to tighten government expenditure.

“Economic growth will be driven by agriculture, housing, and infrastructure,” he stated, adding that the government plans to continue improving farming techniques to ensure good harvests and introduce a 25-year low-interest mortgage to address the housing deficit.

In addition to the HMDI, Edun emphasized that the government is transitioning from concessional and bilateral financing to more affordable funding options, such as domestic bond issuance.

He also reaffirmed the government’s commitment to resolving pensioners’ legacy debts, with over N700bn in bonds already issued for pension payments.

Despite Nigeria’s continued reliance on oil, Edun reiterated efforts to create a safer, investor-friendly environment for the oil sector, calling for the maximisation of revenue from fossil fuels while encouraging public-private partnerships, joint ventures, and privatisation to stimulate investment.

“Now is the time for equity, revenue generation, and private sector participation, both domestically and internationally,” Edun concluded.

NNPC announces plan to list on stock market

Also, the Nigerian National Petroleum Company Limited on Thursday said the national oil company is at the final stages of preparing for an Initial Public Offering (IPO), in compliance with the Petroleum Industry Act (PIA) 2021.

NNPC Ltd’s Chief Finance and Investor Relations Officer, Olugbenga Oluwaniyi disclosed this during a consultative meeting with partners at the NNPC Towers in Abuja on Thursday.

While this is not the first time the state oil firm has announced the plan, Oluwaniyi said the company is currently engaging prospective partners through an “IPO Beauty Parade” as part of regulatory requirements before the official share offering.

The exercise, according to a statement signed by the company’s spokesman, Olufemi Soneye aims to assess potential partners who can support the company in three key areas of Investor Relations, IPO Readiness Advisory, and Investment Banking.

NNPC Ltd plans to select the most competitive proposals for these roles, ensuring the success of its transition into a publicly traded entity.

An IPO would allow NNPC Ltd to sell shares to institutional investors, a significant step towards financial transparency and operational efficiency.

The PIA mandates the listing of NNPC Ltd’s shares in accordance with the Companies and Allied Matters Act (CAMA) 1990, marking a major shift from its long-standing state-owned structure to a commercially driven entity.